Lease-to-own cars in the UAE

car leasing with insurance

Our partners

Own any car in the UAE with only 2 documents. Absolutely hassle-free. No credit history, no certificates required. Order a car for leasing-to-own in Dubai from TakeAuto.

TakeAuto works with the world's leading automakers

SUBMIT and get a FREE consultation from the car expert

Lease Services

Rent Services

Quick Links

Hyundai sonata

FOR 24 MONTHS

Initial fee

Per month from:

Redemption payment:

1000

4.016

15.500

AED

AED MONTHLY

AED

The easiest & fastest way to get a car in the UAE

Only 2 documents

Only 25% down payment

The car is yours in 2 years

No hidden fees and fines

Any car you dream of

We need only your passport/ID and driving license. No credit history. No certificates required.

This amount is already included in the purchase of your car

At the end of the leasing period you pay a symbolic redemption payment of 1000 dirhams and the car becomes your entire property!

All payments are fixed and stipulated in the Leasing Agreement. We DO NOT charge late fees

Our experts will help you choose any car from the market — new or used, at the best price. The only term is that it should not be older than 2021

5 simple steps to get your dream car

Choose a car

Our experts will check it according to 125 parameters

02

Sign an agreement

01

03

In 1 or 2 years — the car is in your total ownership!

05

04

Make the down payment and take your car

Get a free consultation from our specialist right now

0 AED instead of 1500 AED

Car selection tailored to your needs

Lease-to-own calculation based on your capabilities

Car inspection covering 125 parameters

We have sold more than 300 cars in 2.5 years!

Watch video reviews from our valued customers

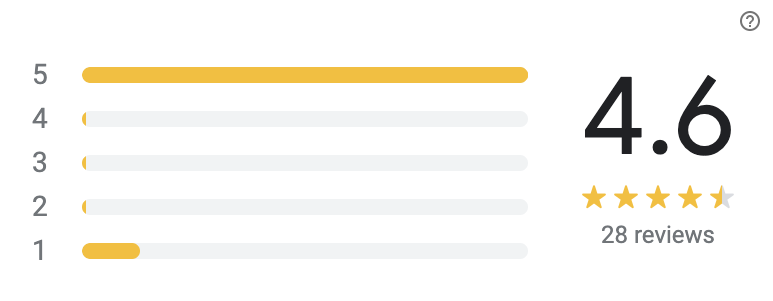

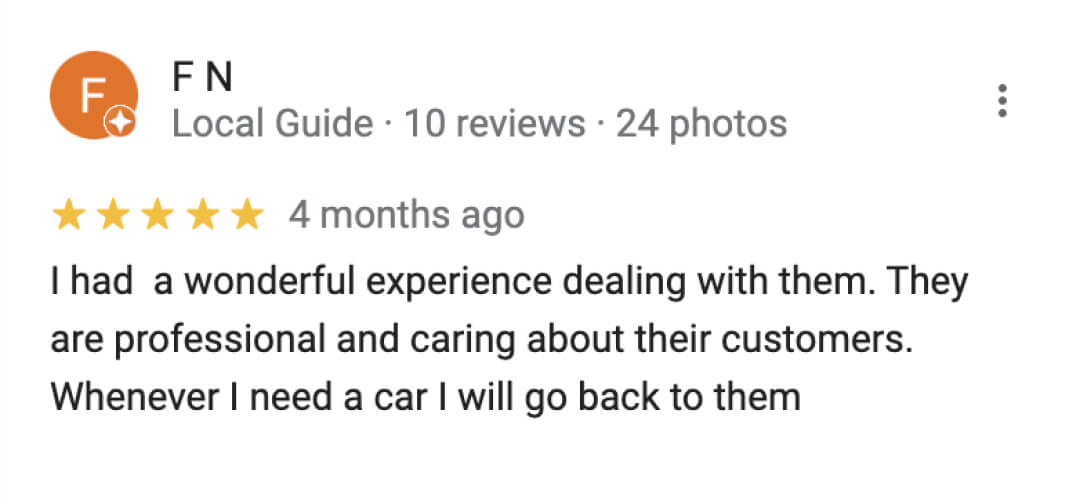

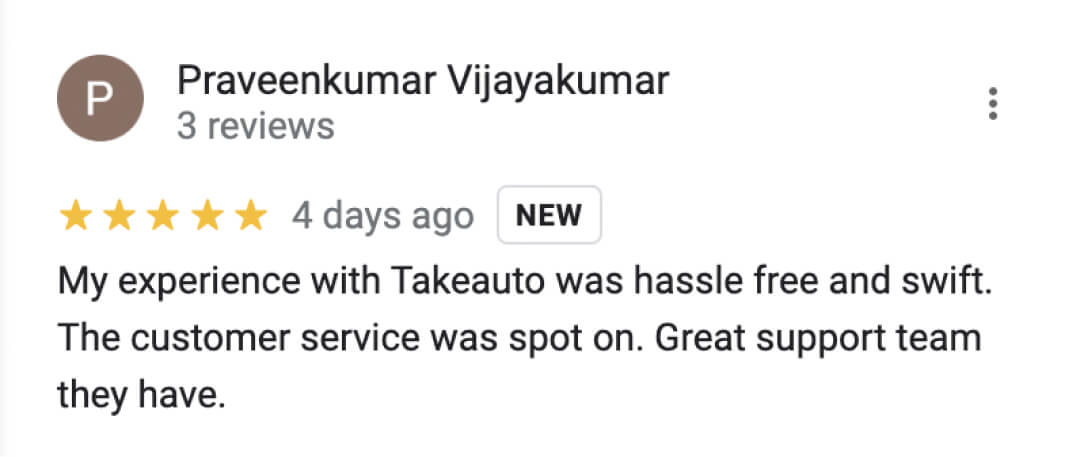

Here’s what our beloved customers write about us on Google

Follow us on Instagram to see more reviews and other useful information about cars in Dubai!

Join the ranks of our satisfied customers!

With TakeAuto you will get

A personal manager available 24/7

Professional car experts who will select, inspect, and purchase a car for you

A security service that will be in touch with you after the car is delivered

The most enjoyable and straightforward experience of buying your dream car :)

A fixed lease-to-own program: down payment 15−25%, monthly payments for 12−36 months, redemption payment 1000 AED

The opportunity of same-day delivery for cars in stock

Payments methods

Cash

Card

Cryptocurrency

Bank transfer

Car financing through a loan

Leasing-to-own with TakeAuto

Advantages:

Advantages:

Less overpayment

Installment plans longer than 3 years

Lots of documents required

Check credit history and job certificates

Takes a lot of time

Disadvantages:

Some banks don't operate according to Islamic standards

Approval rate is really low

If you can't make payments on the loan, there will be significant penalties and fines

Difficult for expats to obtain

Perfect for expats

Only 2 documents required — passport/ID and driving license

Credit history is not checking, no job certificates required

Same-day delivery is available (for cars in stock)

Approval rate is 98%

Disadvantages:

Our operating principles are 100% halal, including the leasing agreement

NO fines or penalties

The overpayment is higher than the loan — due to us taking on ALL the risks

Limited leasing plans (maximum for 3 years)

Difference between leasing with buyout option and auto loan

FAQ

We can offer you an insurance for both Business and Personal use of your insured leased vehicle. You are not restricted to the types of journey you make, subject to trade usage criteria detailed in your contract.

A car lease including insurance takes all the stress out of leasing a vehicle. You can be confident that you are completely covered from day one.

We provide a range of car leasing with insurance options. This makes it easier to find the perfect lease and insurance package for your requirements.

We provide a range of car leasing with insurance options. This makes it easier to find the perfect lease and insurance package for your requirements.

You can choose whichever type of lease you're after whether its a personal car lease with insurance included or a business lease deal with insurance. Reduce the stress and hassle and ask our managers about comprehensive car insurance, car lease insurance.

You can choose a car leasing with insurance. You can lease brand new car or used car: Electric vehicles; Hybrid cars; Tesla; BMW; Audi; Citroen; Kia; Cupra; Skoda; Jaguar; Porsche; Lexus; Ford; Fiat; Seat; Renault; Land Rover; Volkswagen; Honda; Mazda; Subaru; Jeep; Suzuki; Genesis; MG; SsangYong.

As long as the leaseholder is the main driver on the insurance, the driver's spouse or partner and immediate family members (parents, siblings, children) can drive the car as long as they meet the eligibility requirements.

If you’ve taken out business car leasing then any employee, employee’s spouse or partner and immediate family (parents, siblings, children) can drive the vehicle provided they meet the eligibility. However, we are not able to lease if the car will be used as a taxi, hired out, will be as courtesy car etc.

If you’ve taken out business car leasing then any employee, employee’s spouse or partner and immediate family (parents, siblings, children) can drive the vehicle provided they meet the eligibility. However, we are not able to lease if the car will be used as a taxi, hired out, will be as courtesy car etc.

Now, basically, we work under the order. We pick up the car at the request of the client from the market, or we will buy out the option that the client himself offered. Cars are not older than 2020. Our fleet is large and we offer a wide range of cars. Book now, what you want. You can get a new car for a long-term rental. About all the terms and conditions of personal contract hire agreement we can tell you more detailed when you contact us.

We have successfully implemented leasing projects in the CIS countries, highly qualified and experienced specialists in each department, a guarantee of transparency, and we also recommend looking at the reviews of customers who have already bought cars from us.

If you have not yet had experience with car leasing, you should contact us to lease vehicle. It is easy and simple to select and to rent any car and conquer the road. Our price low. Our benefits are obvious, and the requirements are understandable even for non-residents of the country.

If you have not yet had experience with car leasing, you should contact us to lease vehicle. It is easy and simple to select and to rent any car and conquer the road. Our price low. Our benefits are obvious, and the requirements are understandable even for non-residents of the country.

If the car has been in an accident then it is the same as any other situation, you would need to get in touch with our company and insurance company. If you have business contract hire, you should contact us as fast as you can.

A Lease Agreement is concluded with the client, all the terms of the transaction are indicated, the payment schedule and the act of acceptance and transfer of the vehicle are also attached. The amount of the contract is fixed (without interest), the customer pays for insurance on the vehicle separately.

If you don't want to worry about daily or weekly rental car payments, please contact us. We offer cars with a monthly payment. Our deals are transparent, without hidden commissions and payments. You can reserve now on our website online. Contact our support for more details for personal leasing and corporate leasing.

If you don't want to worry about daily or weekly rental car payments, please contact us. We offer cars with a monthly payment. Our deals are transparent, without hidden commissions and payments. You can reserve now on our website online. Contact our support for more details for personal leasing and corporate leasing.

No problem! We can arrange a car with a valid driving license of your country and a tourist visa.

Our car hire works for you. Our locations for car rental Dubai and customer service:

Business Central Tower

Tower B, office 1103B

https://goo.gl/maps/XyVBr3wQeAKSS1jg8

Business Central Tower

Tower B, office 1103B

https://goo.gl/maps/XyVBr3wQeAKSS1jg8

Our services:

You can select booking type - short term rentals, long term rentals. Apply for a lease contract right now. With us all your vehicle costs are transparent and easy to manage.

- Car rental.

- Car lease.

- Used vehicle sales.

- Truck lease.

You can select booking type - short term rentals, long term rentals. Apply for a lease contract right now. With us all your vehicle costs are transparent and easy to manage.

- Maintenance and repair costs. The leasing company takes care of all maintenance and repair costs, so you don't have to worry about unexpected expenses.

- Roadside assistance and replacement vehicle. If your car breaks down while you're on the road, the leasing company will provide you with roadside assistance and also a replacement vehicle.

- No depreciation and annual registration. When you lease a car, you don't have to worry about its value depreciating over time. The leasing company takes care of all depreciation costs and annual registration of the car.

Benefits of car leasing with insurance

Car leasing with insurance can offer several benefits to individuals who are looking to drive a new vehicle without the upfront costs of purchasing a car. Here are some of the advantages of car leasing with insurance:

- Lower Upfront Costs. When you lease a car, you typically pay a lower upfront cost than you would if you were buying a car. This can be especially beneficial if you don't have the funds to purchase a car outright.

- Newer Vehicle. Leasing a car allows you to drive a newer vehicle with the latest technology and features. Lease car can provide you with a more enjoyable driving experience and may even increase your safety on the road.

- No Resale Hassles. When you lease a car, you don't have to worry about the hassles of selling the car when you're ready to upgrade. Instead, you simply return the car to the dealership and can lease a new one if you choose.

- Insurance Included. Many car leasing agreements include comprehensive car insurance as part of the lease package. This can provide you with peace of mind knowing that you're covered in case of an accident or other unforeseen event.

- No problem with lease vehicle. A car lease with insurance includes service and maintenance, road tax, breakdown cover and more. With just one fixed monthly cost, car leasing with insurance is all-inclusive and hassle-free.

Overall, car leasing with insurance can be a smart financial decision for driver for those who want a new car without the upfront costs and potential resale hassles of owning a vehicle. However, it's important to carefully review the terms and conditions of any leasing agreement to ensure that you understand the costs and obligations involved.

Shokhidjon Mukhammedov

Head of Sales

Zelimkhan Zakirov

Managing director

TEAM

Said Zaliev

Founder

Sales manager

Nikita Kozhemyakin

Abdurakhman Gamzatov

Pre-owned car expert

Auto Expert

Davron Matchanov

Muhammad Imad

Sales manager

Alikhan Bursagov

Sales manager

still have questions?

Get a free сonsultancy

Just type your contacts

By clicking on the button, I consent to the processing of my data